Great Info About How To Choose Elss

It is preferable to choose funds with a consistent investment pattern rather than funds with a regularly changing investment pattern because the latter carries a larger risk.

How to choose elss. Capital gains of up to rs 1 lakh. Select funds carefully after examining the consistency of. Try to know his/her qualification, experience, track record, etc.

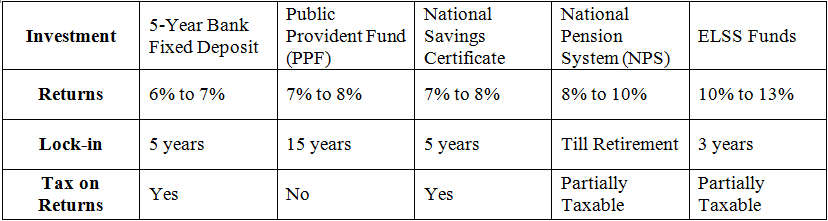

Yes you have successfully opened an account and now you are ready to invest. Further, consider starting a monthly sip in the chosen elss fund from april 2022 onwards to claim a tax deduction against the same for tax liability in fy23. Till the beginning of fy 2018, elss capital gains / profits were tax free but a change in taxa on was introduced in this year's union budget.

Equity linked savings scheme is the only category of mutual funds to provide investors with tax saving benefits. As a general rule, elss fund requires at least 80% of its investment in equity instruments. This is one of the essential things to see while investing in any mutual fund and elss is no.

Before investing in an elss, do some research regarding the fund manager. How to choose tax saving elss mutual funds?what’s better than investing in a mutual fund? If necessary a 4000 lump sum can be put into elss.

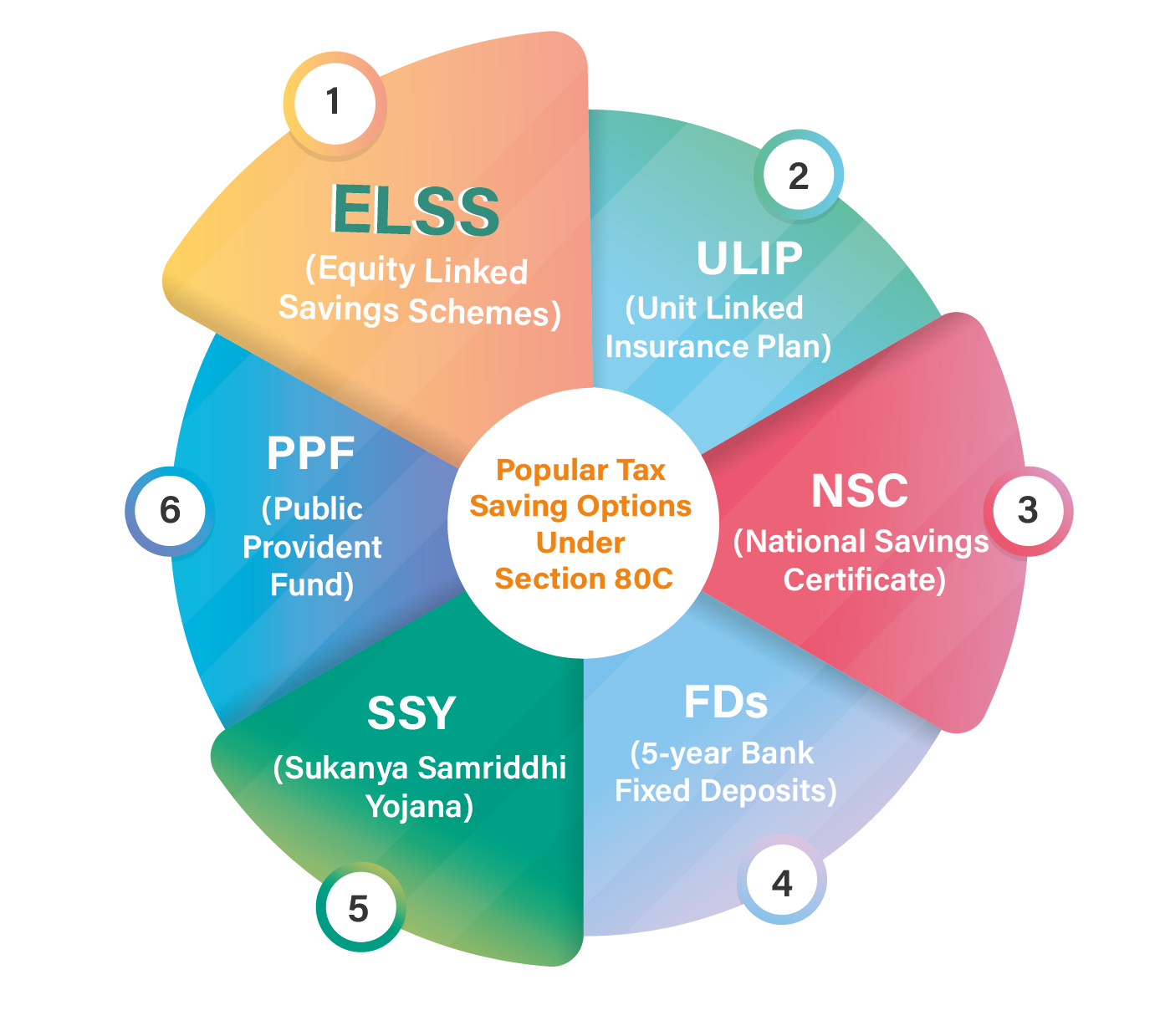

In the first cut, 34 funds were shortlisted. How to choose an elss fund for investment? Investment in elss funds is eligible for tax benefit under section 80c of the income tax act.know the steps to invest in elss & where to open an elss account.

Suppose the asset allocation desired is 50% equity and 50% fixed income and total investment = 17000 +8000 (epf) =. Click on invest now option on home page and select the fund chosen fund using step 2. However, if you have a conservative risk profile, going with a diversified.