Simple Info About How To Buy Canadian Bonds

You may purchase government of canada bonds denominated in u.s.

How to buy canadian bonds. As well as canadian dollars; With most bonds, you’ll get regular interest payments while you hold the bond. Choose a csb or cpb.

You can buy them electronically via treasurydirect, with an individual limit of $10,000 per person per calendar year. The minimum investment for purchasing a canadian treasury bill is ca$1,000. Xgb provides exposure to federal,.

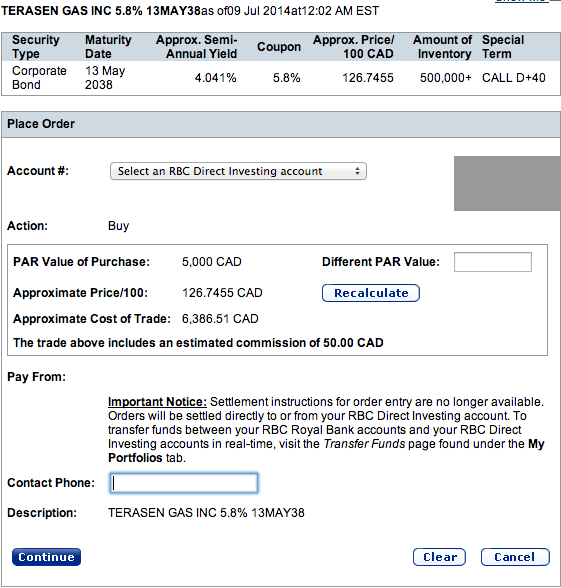

You can buy canadian treasury bills from a financial institution or from a broker. They usually pay a fixed rate of interest for a fixed. Choosing a trading platform that supports bonds.

Both are considered canadian content within your rsp/rrif. Government savings bonds are guaranteed investments issued by the federal or provincial governments. Decide how much to invest.

Laddering involves buying a series of bonds with ascending maturities. How to buy canadian government bonds step 1 � do market research. If it’s diversity in bond holdings you seek (and diversification is always a good idea) you can buy an etf or.

44 rows the government of canada bond purchase program (gbpp) was established to address strains in the government of canada bond market, and to enhance the effectiveness. As of december 2021, all canada savings bonds and canada premium bonds have reached maturity and stopped earning interest. Bmo’s flagship bond etf does quite a bit better, offering investors a payout in the 3.5% range.