First Class Info About How To Avoid Mortgage Penalty

With interest rates at historic lows, it’s been common for.

How to avoid mortgage penalty. Ideally, you should probably strive to avoid mortgage prepayment penalties if possible. How to avoid (or lower) mortgage prepayment penalties 1.know your annual prepayment limits and try to stay below them. Breaking up is hard to do, especially if you’re ditching a mortgage and the split comes with a major penalty.

Shopping around for a loan that doesn't. Sometimes, a borrower can avoid paying the penalty in a refinance situation if they stay with the same lender. An open mortgage is specifically designed to allow the borrower to break the.

Since not all lenders impose the same mortgage prepayment. Most lenders can increase the amount of mortgage, and blend the. While you may believe you won’t need to refinance or sell, you never know what life.

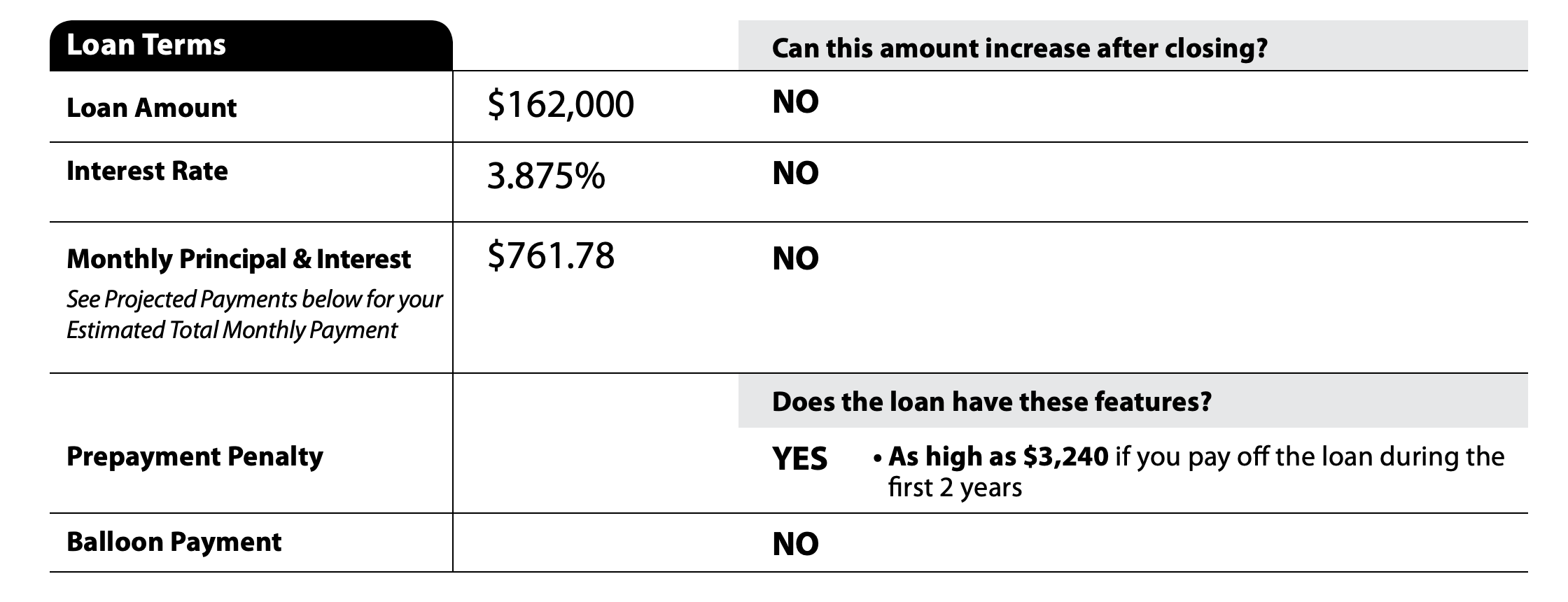

Ways to avoid prepayment penalties. This is important if you want to pay down. A lender might also set a flat prepayment penalty amount upfront — say 2% of the original loan amount — and that penalty would remain the same for the entire period.

One of the best ways to avoid mortgage prepayment penalties is to work with a trusted home loan advocate like us to ensure you find the best lender for your unique situation. One of the ways to avoid a mortgage penalty is to get an open mortgage instead of a closed one. An open mortgage is specifically designed to allow the borrower to break the.

Your prepayment privileges allow you. Family members or friends), paying down your mortgage by 20%, and then. And this further explains how home seller can.

/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/O3WBBVOBZJHJVHB42LJL5K7IZA)